Introduction

IBM, or International Business Machines Corporation, has a storied history in the realm of technology. Founded in 1911, IBM has been at the forefront of technological innovation for over a century. Its contributions range from pioneering computer systems to leading advancements in artificial intelligence and quantum computing. When you think of IBM, you think of a company that has consistently pushed the boundaries of what technology can achieve.

But what makes IBM stand out in the crowded tech landscape? For starters, IBM has an unparalleled commitment to research and development. The company invests billions of dollars annually into R&D, ensuring that it remains a leader in the tech industry. This dedication has resulted in numerous breakthroughs, including the development of the mainframe computer, which revolutionized business operations globally. Furthermore, IBM’s emphasis on innovation has kept it relevant even as the tech industry undergoes rapid changes.

Understanding FintechZoom IBM Stock Performance

Investing in FintechZoom IBM Stock provides a unique opportunity to delve into the financial intricacies of this tech behemoth. IBM’s stock has experienced its share of highs and lows, reflecting the company’s dynamic nature and the volatile tech market. Over the years, IBM’s stock performance has been influenced by various factors, including technological advancements, strategic acquisitions, and market trends.

To truly grasp FintechZoom IBM Stock performance, one must consider its financial statements and key performance indicators (KPIs). Revenue growth, profit margins, and cash flow are critical metrics that provide insights into the company’s financial health. Additionally, understanding IBM’s competitive landscape is crucial. The tech industry is highly competitive, with major players like Microsoft, Amazon, and Google vying for market share. IBM’s ability to adapt to changing market conditions and leverage its strengths has been pivotal in maintaining its FintechZoom IBM Stock value.

Real-Time Insights and Analysis

FintechZoom IBM Stock offers investors a comprehensive platform to track FintechZoom IBM Stock performance in real-time. With FintechZoom, you can access detailed charts, financial news, and expert analysis, all tailored to provide a deep understanding of IBM’s market position. This level of insight is invaluable for making informed investment decisions.

What sets FintechZoom apart is its user-friendly interface and robust analytical tools. Whether you’re a seasoned investor or a novice, FintechZoom IBM Stock platform is designed to cater to your needs. You can easily monitor IBM’s stock trends, set up alerts for significant price movements, and even access historical data to identify patterns. Moreover, FintechZoom IBM Stock expert commentary provides additional context, helping you understand the underlying factors driving FintechZoom IBM Stock performance.

IBM’s Strategic Acquisitions

IBM’s growth strategy has been significantly shaped by its strategic acquisitions. Over the years, IBM has acquired numerous companies to enhance its technological capabilities and expand its market reach. These acquisitions have played a crucial role in diversifying IBM’s product portfolio and driving innovation.

One of IBM’s most notable acquisitions was Red Hat, a leading provider of open-source software solutions. This $34 billion acquisition in 2019 marked a significant milestone in IBM’s cloud computing strategy. By integrating Red Hat’s technologies, IBM strengthened its hybrid cloud offerings, enabling businesses to seamlessly manage workloads across on-premises and cloud environments. This move not only positioned IBM as a leader in the cloud space but also provided a new revenue stream, positively impacting its FintechZoom IBM Stock performance.

IBM’s Quantum Computing Advancements

Quantum computing represents the next frontier in technology, and IBM is at the forefront of this revolution. IBM’s quantum computing initiatives have the potential to transform industries by solving complex problems that are currently beyond the capabilities of classical computers. This groundbreaking technology has garnered significant attention from investors and researchers alike.

IBM’s commitment to quantum computing is evident through its development of the IBM Quantum Experience platform. This cloud-based platform allows researchers and developers to access quantum processors and experiment with quantum algorithms. By democratizing access to quantum computing, IBM is fostering innovation and accelerating the development of practical quantum applications. For investors, IBM’s leadership in quantum computing represents a promising avenue for future growth and FintechZoom IBM Stock appreciation.

IBM’s Watson and Beyond

Artificial Intelligence (AI) is another area where IBM has made significant strides. IBM Watson, the company’s AI platform, has been instrumental in transforming industries such as healthcare, finance, and retail. Watson’s capabilities range from natural language processing to machine learning, enabling businesses to derive valuable insights from vast amounts of data.

The success of IBM Watson has had a positive impact on the company FintechZoom IBM Stock performance. As more businesses adopt AI solutions to enhance their operations, the demand for IBM’s AI technologies continues to grow. Furthermore, IBM’s ongoing investments in AI research and development ensure that Watson remains at the cutting edge of innovation. For investors, this presents a compelling opportunity to capitalize on the growing AI market.

Cloud Computing

Cloud computing has become a cornerstone of modern business operations, and IBM has positioned itself as a key player in this space. IBM’s cloud computing offerings encompass a wide range of services, including infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS). These services enable businesses to leverage the power of the cloud to enhance scalability, flexibility, and efficiency.

IBM’s acquisition of Red Hat was a strategic move to bolster its cloud computing capabilities. By integrating Red Hat’s open-source technologies, IBM has strengthened its hybrid cloud strategy, allowing businesses to seamlessly manage workloads across on-premises and cloud environments. This has not only expanded IBM’s customer base but also contributed to the growth of its cloud revenue. For investors, IBM’s cloud computing initiatives represent a significant growth driver for the company’s FintechZoom IBM Stock.

Cybersecurity

In an increasingly digital world, cybersecurity has become a top priority for businesses and governments alike. IBM has established itself as a leader in cybersecurity, offering a comprehensive suite of solutions to protect against cyber threats. IBM’s cybersecurity portfolio includes threat intelligence, security analytics, and identity and access management, among other services.

IBM’s cybersecurity initiatives have been instrumental in enhancing the company’s reputation as a trusted partner in safeguarding digital assets. This has not only attracted a growing number of customers but also positively impacted FintechZoom IBM Stock performance. As cyber threats continue to evolve, the demand for robust cybersecurity solutions is expected to rise, presenting a lucrative opportunity for IBM and its investors.

The Role of Blockchain in IBM’s Strategy

Blockchain technology has gained prominence in recent years, and IBM has been at the forefront of its adoption. IBM blockchain solutions are designed to enhance transparency, security, and efficiency across various industries. From supply chain management to financial services, IBM’s blockchain technology is revolutionizing traditional business processes.

IBM blockchain initiatives have been well-received by the market, driving demand for its solutions and contributing to its FintechZoom IBM Stock performance. The company’s blockchain platform, IBM Blockchain, provides businesses with the tools to build and deploy blockchain networks. This has enabled IBM to establish itself as a leader in the blockchain space, further solidifying its position in the tech industry.

IBM’s Commitment to Sustainability

Sustainability has become a critical consideration for businesses and investors alike. IBM has demonstrated a strong commitment to sustainability, implementing various initiatives to reduce its environmental impact. From renewable energy investments to sustainable supply chain practices, IBM is dedicated to creating a more sustainable future.

IBM’s sustainability efforts have resonated with socially conscious investors, enhancing the company’s reputation and attracting a growing number of environmentally focused funds. Furthermore, IBM’s sustainability initiatives align with global trends towards green technologies and sustainable business practices. For investors, IBM’s commitment to sustainability represents a positive aspect of the company’s long-term growth strategy.

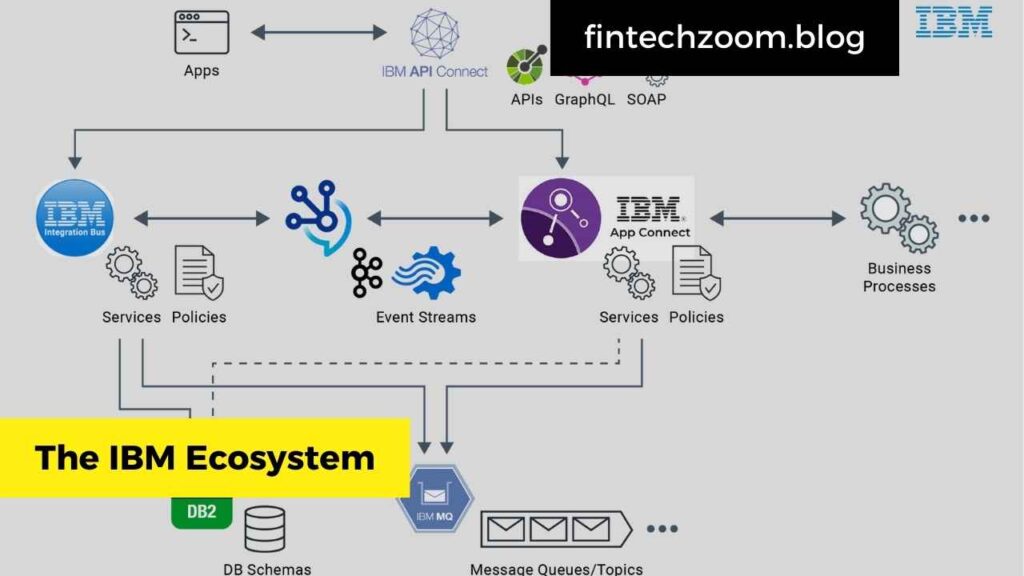

The IBM Ecosystem

IBM’s success is not solely attributed to its internal capabilities but also to its extensive ecosystem of partners. IBM has established strategic partnerships with leading technology companies, academic institutions, and industry organizations to drive innovation and deliver value to its customers.

These partnerships have enabled IBM to expand its reach and enhance its offerings. For instance, IBM’s collaboration with Apple has resulted in the development of enterprise-grade mobile solutions that combine IBM’s analytics and cloud capabilities with Apple’s user-friendly devices. Such partnerships not only strengthen IBM’s market position but also contribute to the growth of its FintechZoom IBM Stock value.

The Impact of Global Events on IBM Stock

Global events, such as economic downturns, geopolitical tensions, and pandemics, can have a significant impact on FintechZoom IBM Stock performance. IBM, like other multinational corporations, is not immune to these external factors. Understanding the influence of global events on FintechZoom IBM Stock is crucial for investors seeking to navigate the complexities of the market.

For example, the COVID-19 pandemic had a profound effect on businesses worldwide, including IBM. The pandemic accelerated the adoption of digital technologies, driving demand for IBM’s cloud, AI, and cybersecurity solutions. However, it also posed challenges, such as supply chain disruptions and economic uncertainty. By analyzing how global events impact FintechZoom IBM Stock, investors can make more informed decisions and mitigate potential risks.

Financial Health

Evaluating IBM’s financial health requires a thorough analysis of key metrics and indicators. Revenue growth, profitability, and cash flow are essential factors that provide insights into the company’s financial stability and growth prospects. Additionally, understanding FintechZoom IBM Stock debt levels and capital allocation strategies is crucial for assessing its long-term viability.

IBM’s financial health is supported by its diverse revenue streams, strong balance sheet, and prudent financial management. The company’s ability to generate consistent cash flow allows it to invest in research and development, pursue strategic acquisitions, and return value to shareholders through dividends and share buybacks. For investors, IBM’s solid financial foundation is a reassuring factor when considering an investment in its FintechZoom IBM Stock.

The Role of Dividends in IBM’s Investment Appeal

Dividends are an important aspect of FintechZoom IBM Stock investment appeal. As a mature and established company, IBM has a long history of paying dividends to its shareholders. Dividends provide a steady income stream and can be particularly attractive to income-focused investors.

IBM’s commitment to returning value to shareholders through dividends reflects its financial strength and confidence in its future prospects. The company’s dividend policy is underpinned by its consistent cash flow generation and disciplined capital allocation. For investors seeking a combination of growth and income, IBM dividend payments add an extra layer of appeal to its FintechZoom IBM Stock.

IBM’s Competitive Landscape

The tech industry is characterized by intense competition, with numerous players vying for market share. IBM faces competition from both established giants and emerging startups across various segments, including cloud computing, AI, and cybersecurity. Understanding IBM’s competitive landscape is essential for assessing its growth potential and market positioning.

Despite the competitive pressures, IBM has several advantages that enable it to navigate challenges and seize opportunities. Its extensive patent portfolio, robust research and development capabilities, and strong brand reputation are key differentiators. Additionally, IBM’s focus on strategic partnerships and acquisitions allows it to stay ahead of the curve and deliver innovative solutions to its customers. For investors, IBM’s ability to effectively compete in the tech industry is a crucial factor in its long-term success.

IBM’s Role in Shaping the Workplace

The future of work is being reshaped by technological advancements, and IBM is playing a pivotal role in this transformation. From remote work solutions to AI-powered productivity tools, IBM is helping businesses adapt to the evolving work landscape. The company’s offerings enable organizations to enhance collaboration, streamline operations, and drive efficiency.

IBM’s contributions to the future of work have been particularly significant during the COVID-19 pandemic. The shift to remote work accelerated the adoption of digital technologies, and IBM’s solutions played a crucial role in facilitating this transition. As businesses continue to embrace hybrid work models, IBM’s innovations will remain integral to shaping the future workplace. For investors, IBM’s leadership in this space represents a promising growth opportunity.

IBM’s Research and Development

Research and development (R&D) is at the heart of IBM’s innovation strategy. The company’s commitment to R&D has resulted in numerous technological breakthroughs and industry-leading solutions. IBM’s research initiatives span a wide range of fields, including AI, quantum computing, blockchain, and cybersecurity.

IBM R&D efforts are supported by its extensive network of research labs and collaboration with academic institutions. This collaborative approach fosters innovation and accelerates the development of cutting-edge technologies. For investors, IBM focus on R&D is a testament to its dedication to staying at the forefront of technological advancements and driving long-term growth.

Expanding Market Reach

IBM’s global presence is a key factor in its market reach and growth potential. The company operates in over 170 countries, serving a diverse customer base across various industries. This extensive geographical footprint allows IBM to tap into emerging markets and leverage growth opportunities worldwide.

IBM’s global operations are supported by its network of data centers, research labs, and sales offices. The company’s ability to deliver localized solutions and provide on-the-ground support is a significant advantage in catering to the unique needs of different markets. For investors, FintechZoom IBM Stock global presence enhances its resilience and positions it for sustained growth in the global economy.

The Evolution of IBM Business Model

IBM’s business model has evolved significantly over the years to adapt to changing market dynamics and technological advancements. The company has transitioned from a hardware-centric model to a services and solutions-oriented approach. This shift has been driven by the growing demand for cloud computing, AI, and other digital technologies.

IBM’s transformation has been marked by strategic acquisitions, divestitures, and organizational restructuring. The company’s focus on high-growth areas such as cloud computing and AI has enabled it to stay relevant in the fast-paced tech industry. For investors, FintechZoom IBM Stock ability to successfully evolve its business model and capitalize on emerging trends is a key indicator of its long-term growth potential.

Also Read: FINTECHZOOM NEWS DIGITAL TRANSFORMATION STRATEGIES 2024

Conclusion

Investing in FintechZoom IBM Stock offers a unique opportunity to gain exposure to a leading technology company with a rich history and a promising future. However, like any investment, it is important to conduct thorough research and consider various factors before making a decision.

When evaluating IBM as an investment, consider its financial health, growth prospects, competitive landscape, and market positioning. Additionally, assess your investment goals, risk tolerance, and time horizon. For long-term investors, IBM’s commitment to innovation, strong dividend payments, and strategic initiatives make it a compelling choice. With FintechZoom IBM Stock comprehensive insights and analysis, you can make an informed investment decision and potentially reap the rewards of investing in FintechZoom IBM Stock.

Faq About FintechZoom IBM Stock

Q1: Is IBM Stock Worth Holding?

Ans:Deciding whether IBM stock is worth holding depends on various factors, including your investment goals, risk tolerance, and market conditions. IBM has a history of providing stable dividends and has been focusing on growth areas like cloud computing and artificial intelligence. Many investors view IBM as a reliable long-term hold due to its strong brand and continuous innovation in technology. However, it’s essential to stay updated with the latest market trends and analyst recommendations.

Q2: What Are Analysts Saying About IBM Stock?

Ans:Analysts have mixed opinions about IBM stock. Some are optimistic about IBM’s strategic pivot towards high-growth areas such as cloud computing and AI, expecting these initiatives to drive future growth. Others are more cautious, pointing to challenges in legacy business segments and competitive pressures. It’s advisable to review a variety of analyst reports and consider factors such as earnings reports, strategic initiatives, and industry trends before making investment decisions.

Q3: Where Will IBM Stock Be in 5 Years?

Ans:Predicting the exact position of IBM stock in five years involves a degree of speculation. Analysts suggest that IBM’s focus on expanding its cloud services, artificial intelligence, and quantum computing could potentially drive significant growth. However, market conditions, technological advancements, and competitive dynamics will play crucial roles. Investors should monitor IBM’s progress in executing its strategic plans and stay informed about industry developments to make well-informed long-term investment decisions.

Q4: Did IBM Stock Split?

Ans:Yes, IBM has had several stock splits in its history. The most recent stock split was a 2-for-1 split on May 27, 1999. Since then, there have been no additional stock splits. It’s important to check the latest information and confirm any recent changes directly from IBM’s investor relations page or other reliable financial news sources.

Q5: How Do I Sell My IBM Shares?

Ans:To sell your IBM shares, you can follow these steps:

- Log In to Your Brokerage Account: Access the account where your IBM shares are held.

- Select IBM Stock: Navigate to the section where your portfolio is listed and select IBM stock.

- Choose the Sell Option: Indicate the number of shares you want to sell and set your selling price or select a market order to sell at the current market price.

- Review and Confirm: Double-check the details of your order and confirm the sale.

Q6: Is IBM a Volatile Stock?

Ans: IBM is generally considered to be less volatile compared to many technology stocks. It has a long-standing reputation for stability and pays consistent dividends, which can appeal to conservative investors. However, like any stock, IBM can experience periods of volatility due to market conditions, earnings reports, and industry developments. Investors should consider their risk tolerance and investment strategy when assessing IBM’s stock volatility.