Introduction

When it involves luxury watches, few manufacturers captivate the creativeness pretty like Richard Mille. Renowned for their futuristic designs, present day materials, and unheard of craftsmanship, those timepieces signify opulence and innovation. However, their extravagant fee tags regularly make them appear out of attain for maximum collectors. But here’s a thought-upsetting query: what is the cheapest richard mille watch price to be had? For enthusiasts and first-time shoppers, discovering the extra available stop of the spectrum might be the gateway to owning a piece of horological records. In this blog, we’ll navigate the captivating global of Richard Mille, uncovering the most low priced alternatives at the same time as explaining why even the access-level fashions maintain brilliant cost.

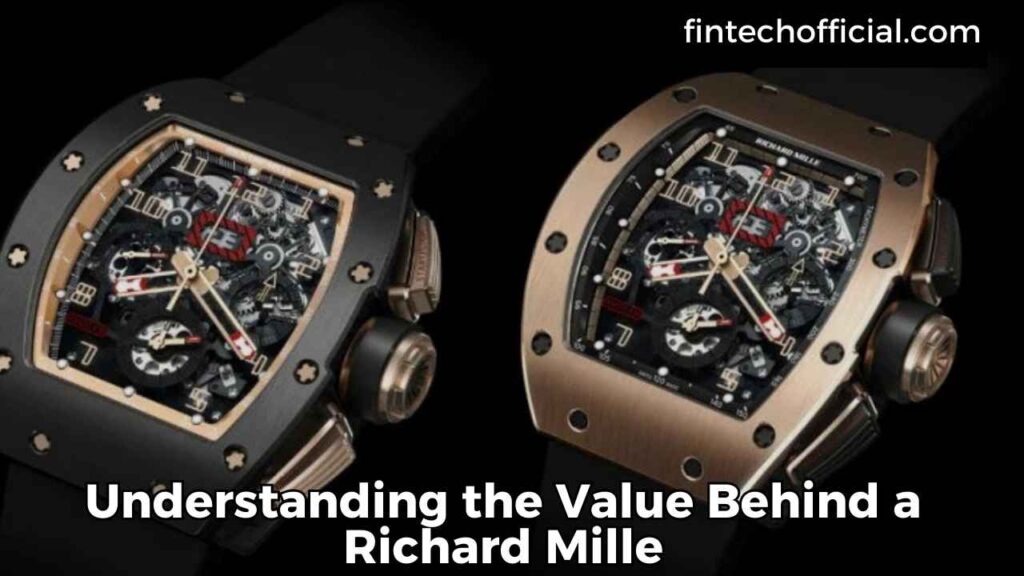

Understanding the Value Behind a Richard Mille

The cost of a Richard Mille watch isn’t pretty much aesthetics; it’s rooted in engineering marvels and precision era. Each model combines aerospace-grade materials with complex movements which can be both lightweight and durable. While browsing for the cheapest richard mille watch price, it’s crucial to understand what you’re purchasing. These watches undergo rigorous craftsmanship techniques, making sure they’re no longer best luxurious but additionally realistic and resilient below severe situations.

The beauty of Richard Mille lies in its approach to mixing art and engineering. Even at the decrease price points, buyers can assume the same dedication to detail and innovation that defines the brand. For instance, the RM half and RM 010 fashions are regularly highlighted as extra price range-friendly alternatives, with out sacrificing the iconic Richard Mille identification.

Exploring Entry-Level Models

Though the majority of Richard Mille watches price properly over six figures, there are fashions that fall into the extra “cheap” luxurious class. When attempting to find the cheapest richard mille watch price, models like the RM 016 and RM 007 stand out. These options usually variety between $50,000 and $eighty,000 on the pre-owned market, making them especially achievable inside the international of extremely-luxury watches.

Pre-owned or antique pieces can substantially lessen the fee, permitting enthusiasts to enjoy the prestige of a Richard Mille watch with out the astronomical charge of more moderen releases. However, it’s critical to paintings with authentic dealers to make certain authenticity, as the call for for Richard Mille watches has also brought about an influx of counterfeit fashions inside the market.

Why Pre-Owned Markets are Game-Changers

For savvy collectors, the pre-owned market offers a treasure trove of possibilities to find the cheapest richard mille watch price. While the brand itself does now not produce price range alternatives, the resale market gives get entry to to older or lightly-used models at a fraction of their unique price. Websites like Chrono24 and specialized watch boutiques are brilliant sources for discovering hidden gem stones. Additionally, pre-owned Richard Mille watches regularly preserve their cost over time, making them not only a luxury buy but also a smart investment.

Another key advantage of choosing pre-owned fashions is the risk to own uncommon or discontinued designs. These watches carry an added allure, as their scarcity increases their desirability among creditors. Choosing a pre-owned Richard Mille doesn’t mean compromising on exceptional—it’s approximately locating price with out losing status.

The Innovation That Defines the Brand

Richard Mille’s revolutionary spirit is contemplated in each watch, even the ones to be had on the lower stop of the charge spectrum. With partnerships starting from Formula 1 to high-overall performance athletes, the logo is devoted to pushing barriers. If you’re considering the cheapest richard mille watch price, relaxation confident that even these fashions contain materials like titanium, LITAL® alloy, and carbon TPT®—additives typically reserved for advanced engineering fields.

Additionally, those timepieces boast capabilities including shock resistance, water resistance, and skeletonized dials, making sure they’re no longer simply visually appealing but also practical. Even the so-known as “access-degree” Richard Mille watches preserve the brand’s popularity for extraordinary innovation.

Is a Richard Mille Worth the Investment?

Investing in a Richard Mille is set greater than simply status; it’s approximately owning a piece of horological mastery. Despite the premium fee tags, even the extra on hand models justify their cost via innovative technology, meticulous craftsmanship, and enduring logo fee. The cheapest Richard Mille watch charge still incorporates the equal prestige as its higher-stop counterparts, making it an splendid entry factor for all people seeking to delve into luxurious watches.

Furthermore, the exclusivity of Richard Mille watches ensures their desirability stays excessive. Whether you’re a pro collector or a newcomer, owning a Richard Mille can be a profitable revel in each in my view and financially.

Where to Begin Your Search

Embarking on the journey to locate the cheapest richard mille watch price calls for staying power and a keen eye. Trusted sellers and public sale houses are critical for making sure authenticity, specifically in a market in which counterfeits can pose a risk. Consider learning on-line systems, travelling boutique watch shops, or networking inside luxury watch boards to explore your options. The thrill of the quest is a part of the posh watch experience, and finding your best Richard Mille at a top notch fee may be immensely gratifying.

Also Read: Fintechzoom.com Best VPN: A Complete Guide 2024

Conclusion

Owning a Richard Mille watch isn’t just a buy—it’s an revel in, a assertion, and a testament to first-rate craftsmanship. For those exploring the cheapest richard mille watch price, the journey well-knownshows a completely unique mixture of innovation, style, and fee, even at the logo’s extra available levels. Every Richard Mille timepiece tells a story of engineering excellence and timeless layout, making sure that irrespective of your price range, you’ll very own an eye that redefines luxurious. Dive into the arena of Richard Mille and discover how a unmarried timepiece can elevate your series and your lifestyle.

FAQ About Cheapest Richard Mille Watch Price

Q1: What is the cheapest Richard Mille watch price?

Ans: The cheapest Richard Mille watches typically start at around $60,000 in the pre-owned market, with entry-level models like the RM 005 and RM 016 offering affordability without sacrificing luxury.

Q2: Are cheaper Richard Mille watches authentic?

Ans: Yes, but ensure you purchase from reputable dealers or authorized resellers to avoid counterfeits. Always request documentation and authentication for peace of mind.

Q3: Can Richard Mille watches hold their value?

Ans: Absolutely! Richard Mille watches, even the entry-level ones, often retain or appreciate in value due to their limited production and high demand.

Q4: Where can I find the cheapest Richard Mille watch?

Ans: Look for pre-owned options through trusted platforms like Chrono24, WatchBox, or authorized luxury dealers for the best deals.

Q5: Why are Richard Mille watches so expensive?

Ans: The high price is due to advanced materials, intricate craftsmanship, and limited production, ensuring exclusivity and exceptional quality in every piece.